Cash Flows from Financing ActivitiesĬash flows from financing activities contains the sum total of the changes that a company experienced during a designated reporting period that were caused by transactions with owners or lenders to either provide long-term funds to the company or to return those funds to the owners or lenders. Cash Flows from Investing ActivitiesĬash flows from investing activities contains the sum total of the changes that a company experienced during the reporting period in investment gains or losses, as well as from any new investments in or sales of fixed assets. Youll typically start with how well the business is generating cash.

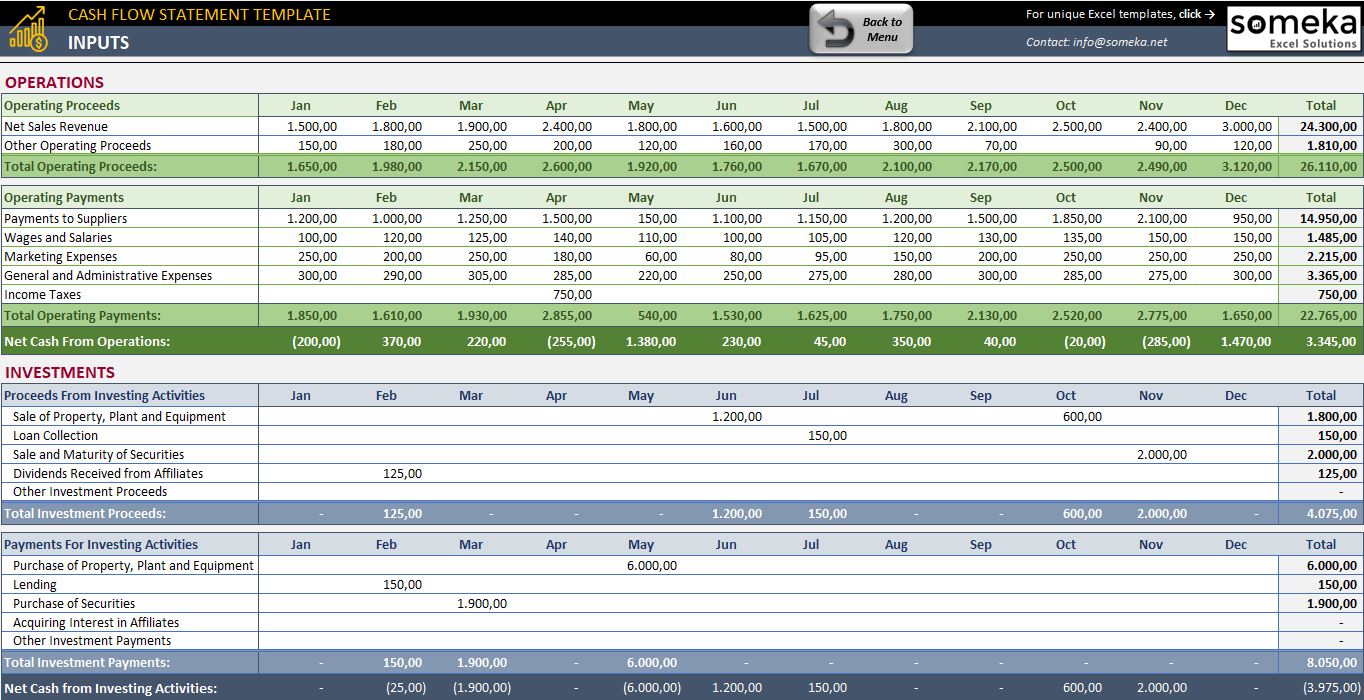

Securities and Exchange Commission (SEC) and the. The cash flow statement tracks and summarizes cash that flows in and out of the business. In our example, Cash collections 3,000,000 - 50,000 2,950,000. Cash Flow Statement: A cash flow statement is one of the quarterly financial reports publicly traded companies are required to disclose to the U.S. Cash Flows from Operating ActivitiesĬash flows from operating activities refer to the primary revenue-generating activities of an entity, such as cash received from the sale of goods or services, royalties on the use of company-owned intellectual property, commissions for sales on behalf of other entities, and cash paid to suppliers. Chapter 6 Statement of Cash Flows The Statement of Cash Flows describes the cash inflows and outflows for the firm based upon three categories of activities. The statement of cash flows is closely examined by financial statement users, since its detailed reporting of cash flows can yield insights into the financial health of a business. A cash flow statement is a financial statement that shows how changes in cash flow are related to the companys activities over a specific period of time. The statement of cash flows is part of the financial statements, of which the other two main statements are the income statement and balance sheet. Presentation of the Statement of Cash Flows Profit before interest and income taxes, xx,xxx Add back depreciation, xx,xxx Add back impairment of assets, xx. The statement is comprised of three sections, in which are presented the cash flows that occurred during the reporting period relating to the following topics noted below. The movement of cash & cash equivalents or inflow and outflow of cash is known as Cash Flow.

#Cash flow statement format professional

A statement of cash flows contains information about the flows of cash into and out of a company, and the uses to which the cash is put. This article is Tax Professional approved.

0 kommentar(er)

0 kommentar(er)